The Indian logistics industry is experiencing tremendous growth, fueled by the burgeoning e-commerce sector and advancements in technology

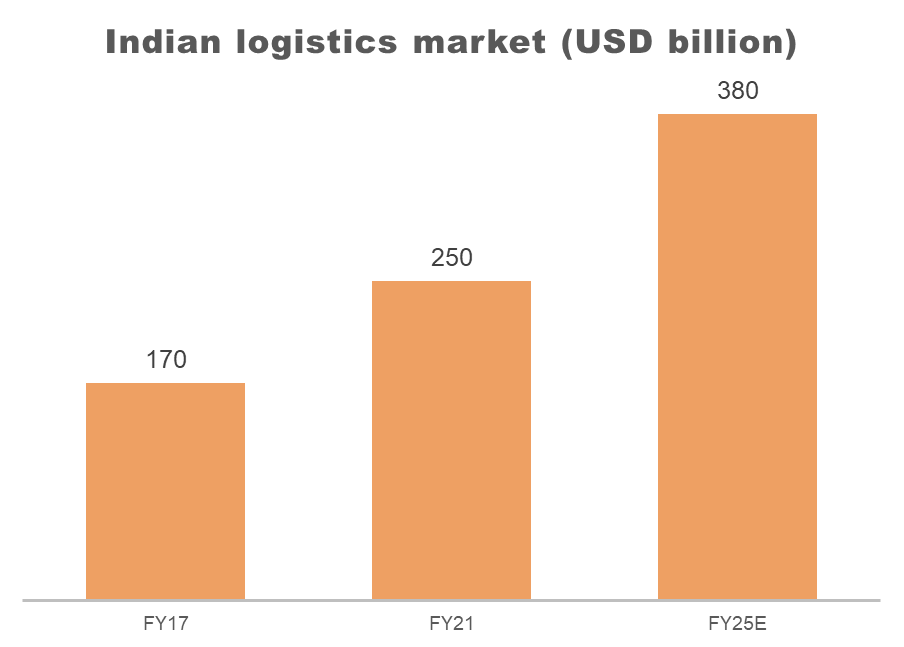

The Indian logistics market is estimated to be worth over $380 billion by 2025. This substantial market size is driven by various factors such as India’s large population, expanding economy, increasing trade volumes, and rapid urbanization

The Leads Index 2021

The Leads Index 2021 identifies top-rated states based on major logistics service and infrastructure factors

States like Maharashtra, Gujarat, Tamil Nadu, have historically performed well in logistics-related rankings in India due to factors such as their industrial base, port facilities, connectivity, and investment climate

key segments within the Indian logistics market

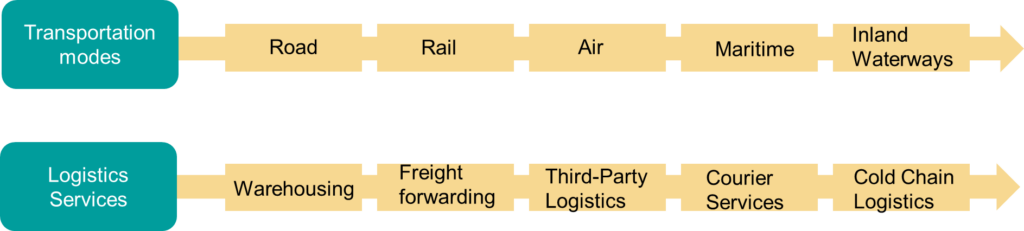

The Indian logistics market can be segmented into various categories based on the services offered and the modes of transportation involved

- Logistics services encompass every aspect of your supply chain, spanning from production facilities to final consumers.

- This includes the transportation of goods from the manufacturer to warehouses, storage and order processing within those warehouses, and the subsequent delivery of products to the end customer

- The adoption of digital solutions, the emergence of 3PL providers, and the growth of e-commerce have all contributed to the changing landscape of logistics services

Market and industry structure

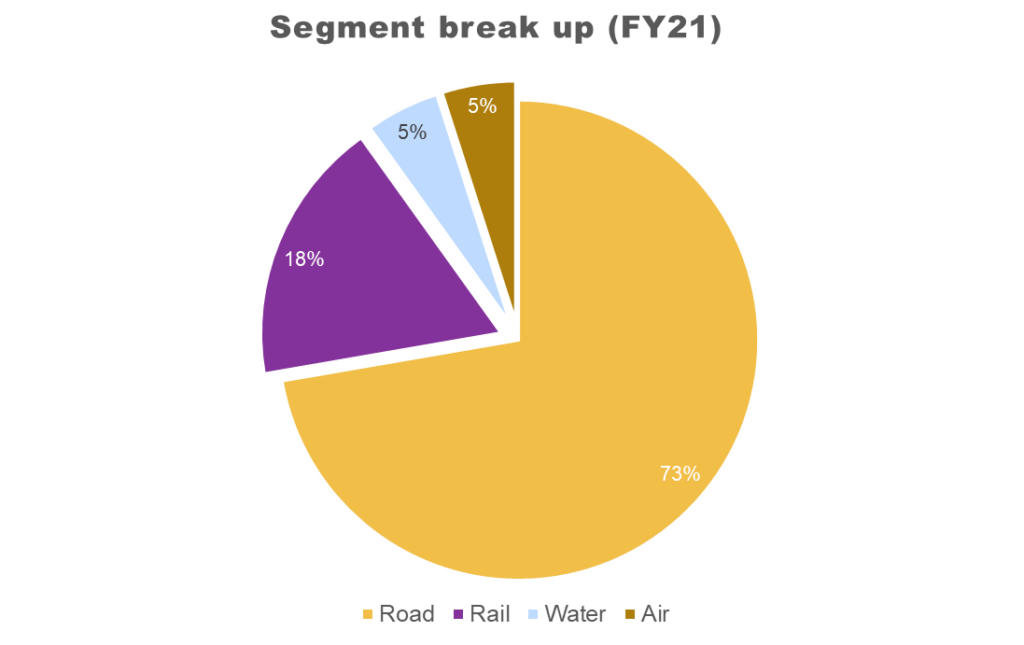

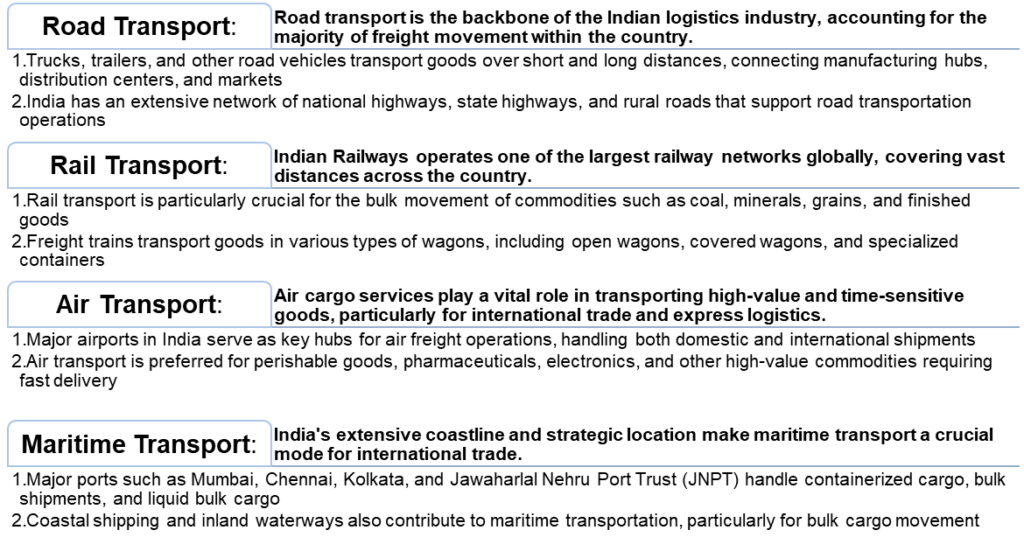

Transportation modes of Indian logistics industry

These transportation modes work in tandem to meet the diverse needs of the industry, catering to different types of cargo, distances, delivery times, and cost considerations

Source : Logistics on the cusp of a transformation, Motilal Oswal, October 2021

Value added logistics services

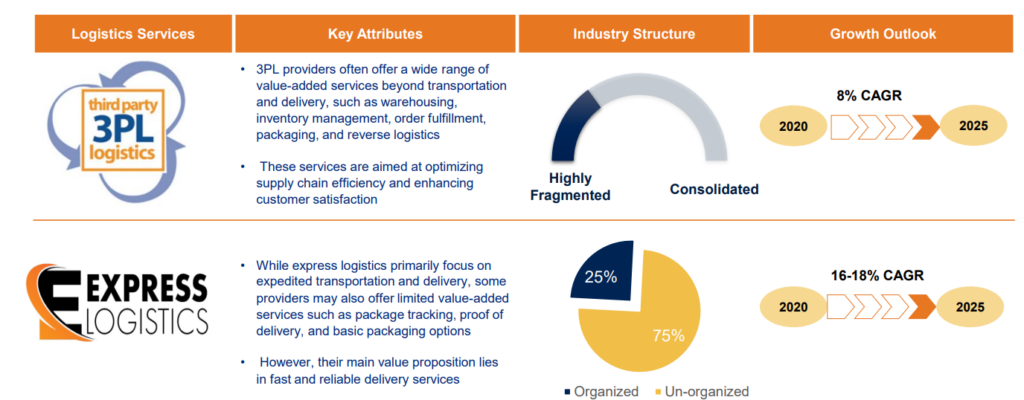

Both 3PL and Express logistics services offer value-added solutions to optimize supply chain operations and meet the evolving needs of businesses and consumers

Source : Indian express logistics industry 2022, Indian Chamber of commerce and Aviral

Peer landscape

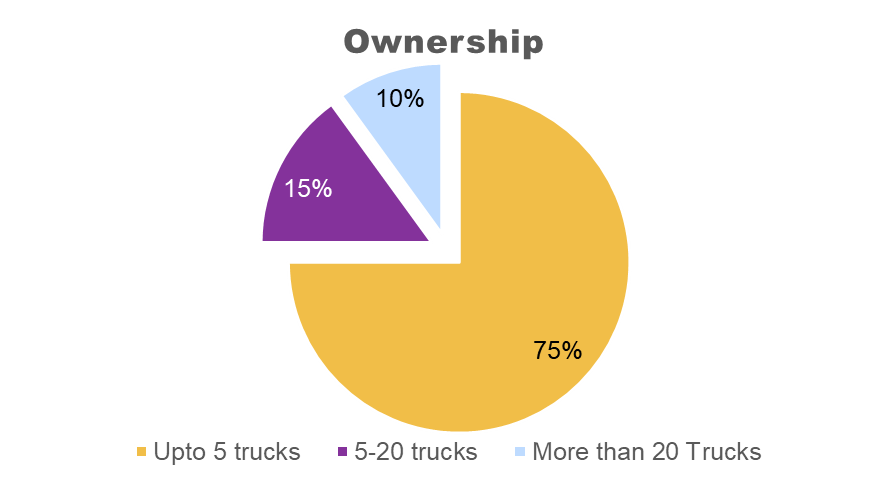

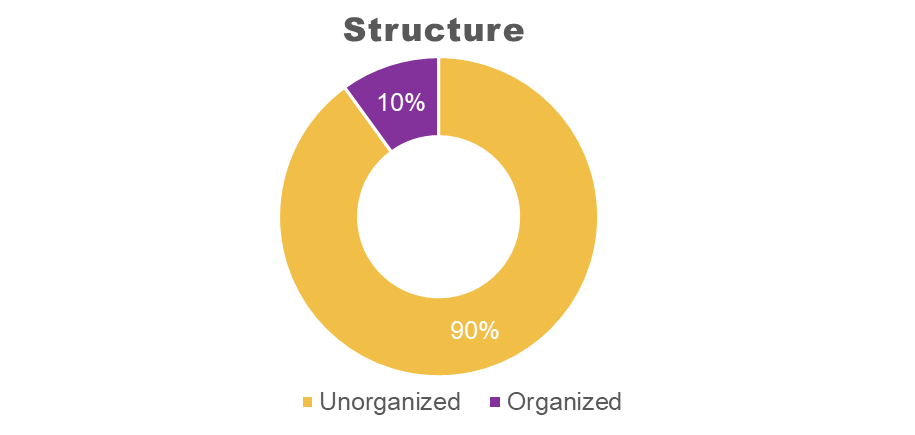

The industry is characterized by a high level of fragmentation, with the participation of numerous small, disorganized entities

The Road logistics industry is beset with structural problems as the industry is dominated by small owner operators

- The NITI Aayog report highlighted that a significant majority, over 75%, of road transportation in India is dominated by small owner-operators who possess fewer than five commercial goods carriers. Moreover, a mere 10% of these operators own more than 10 trucks

- These small players heavily rely on intermediaries, with a substantial pool of 1-2 lakh brokers facilitating their operations

Tough regulations and navigating diverse state rules have significantly contributed to the industry’s disorganization and fragmentation

- • In the last 7-8 years, technology-driven aggregators have joined the industry, comprising only about 2-3% of the market and influencing just a quarter of the trucks in operation •

- •Consequently, this has affected the scalability of operations and the competitiveness of pricing. More than a quarter of trucks are engaged in dry runs or dead miles, meaning they operate under capacity or return empty after delivering goods

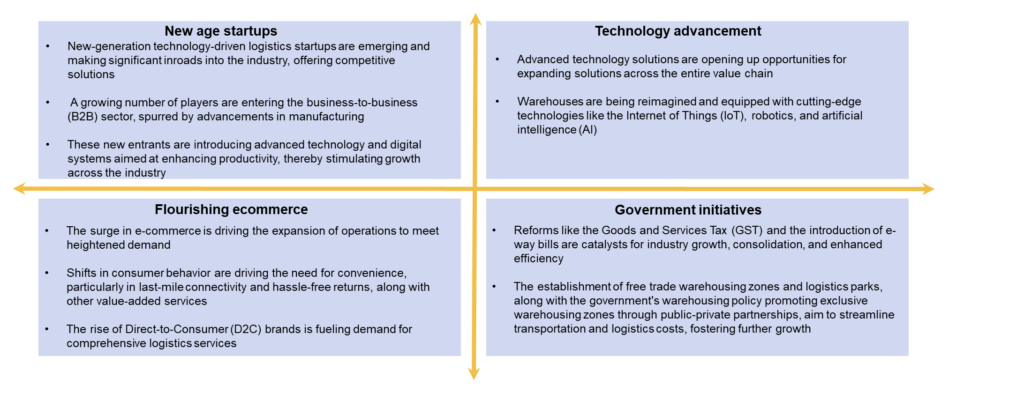

Key industry drivers

Ecommerce demand, technological advancements, and startup activity are driving market expansion

Source : . How the new warehousing policy will transform India’s logistics, Mint, 22 December 2021; 2. Budget speech document 2022-2023, 1 February 2022

0 Comments